Contact: [email protected]

COLSTRIP, Mont. — Alongside former Montana Governor Brian Schweitzer, Ryan Busse and Raph Graybill today rolled out their simple plan to lower residential property taxes in Montana as Greg Gianforte’s “unnecessary, time-intensive, taxpayer-funded ‘task force’” suggested more taxes and more red tape.

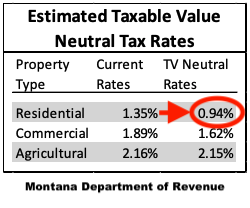

The Busse/Graybill plan: Lower Montana’s residential property tax rate from 1.35% to 0.94%, as suggested by the Montana Department of Revenue in November of 2022.

Lowering the tax rate, which previous Republican and Democratic governors have done as home values increased, would result in meaningful, permanent property tax relief for all Montana homeowners and renters. Lowering the tax rate would also prevent homeowners from having to subsidize corporate tax relief, put more money in their pockets without opt-in rebates, and would make a measurable dent in Gianforte’s housing and affordability crisis.

Busse, a former firearms executive running for governor, detailed his plan after Gianforte’s Property Tax Task Force formally delivered “a complicated, multi-point plan that ultimately means more taxes and doesn’t provide immediate, permanent tax relief to ordinary Montanans.”

“Gianforte didn’t get the memo even when his own Department of Revenue put it right under his nose and said, ‘look!’” Busse said from Colstrip, Mont. “Montanans in every corner of this state are hopping mad about Gianforte’s property tax increase, especially when they learn his property taxes went down last year. Instead of a tax cut, the Governor delivered only more taxes and more red tape.”

The Busse/Graybill Property Tax Plan:

1. Cut the rate

2. Cut taxes

3. Cut the red tape

Yep, that’s it! It only sounds elementary because instead of lowering Montana’s homeowner property tax rate in response to an unprecedented tax crisis, Gov. Greg Gianforte opted instead for red tape, convening an unnecessary, time-intensive, taxpayer-funded “task force” made up of 23 people—some from out-of-state—to come up with a complicated, multi-point plan that ultimately means more taxes and doesn’t provide immediate, permanent tax relief to ordinary Montanans.

The Busse/Graybill Property Tax Plan takes its cue from Gianforte’s own Revenue Department, which in late 2022 advised lowering the residential property tax rate from 1.35% to 0.94% in order to prevent the State of Montana from receiving more than it should from taxpayers due to higher home values (or, as the Revenue Department puts it, to “provide a taxable value neutral rate.”)

Four previous governors (Democrats Steve Bullock and Brian Schweitzer, and Republicans Judy Martz and Marc Racicot) all adjusted the residential property tax rate to provide a taxable value neutral rate when home values increased.

But neither Gianforte nor his Republican supermajority in the Montana Legislature took that advice, causing homeowner property taxes to increase by $259 million a year and shifting corporations’ local property tax obligations to homeowners, resulting in enormous property tax breaks for out-of-state corporations like NorthWestern Energy and BNSF Railway.

This also resulted in an average residential property tax increase of 21 percent in 2023 compared to 2022. Despite Gianforte regularly complaining that “property taxes are too high” at every opportunity, including in yet another taxpayer-funded campaign letter sent to all homeowners this month, Montana homeowners will not see meaningful, permanent property tax relief this year. That’s because Gianforte has failed to do what Busse and Graybill are proposing.

The Busse/Graybill Property Tax Plan is remarkably simple, and will be a “Day One” priority for their administration: Lower the residential property tax rate from 1.35% to 0.94%, or by whatever measure the Department of Revenue advises—as required by law—to ensure a taxable value neutral rate. Their simple plan would:

- Immediately result in property tax relief for all Montana homeowners and renters;

- Prevent homeowners from having to subsidize corporate tax relief;

- Put more money in the pockets of Montana taxpayers without burdensome, opt-in rebates;

- Make a measurable dent in the housing and affordability crisis that Gianforte has failed to address.

QUICK FACTS:

- Pronunciation: Ryan BUSS’-ee

- Home: Kalispell, Mont.

- Office Sought: Governor of Montana

- Affiliation: Democrat

- Website: busseformontana.com

- X (Twitter): @ryandbusse

- DOB: 2/23/70 (53)

- Occupation: Writer, Consultant, Firearms Expert and Former Executive (Vice President of Sales, Kimber America: 1995-2020)

- Family: Married to Sara for 24 years; two sons: Lander (18) and Badge (15)

- Alma Mater: Bethany College (Kansas)

- Chevy Odometer: 280,000 miles

- Hunting Dogs: Aldo and Teddy

- Bio: Ryan Busse is an author and former firearms executive who helped build the gun company Kimber from Kalispell between 1995 and 2020. Over his 25-year career Busse directed the sales of nearly three million Kimber firearms. His memoir, Gunfight: My Battle Against the Industry that Radicalized America, was published by PublicAffairs (Hachette) in 2021. Busse was born near the Kansas cattle ranch homesteaded by his great-grandfather. He is an avid hunter, angler and champion of public lands, and has held leadership positions with Backcountry Hunters and Anglers and Montana Conservation Voters. Busse and his wife Sara live in Kalispell and have two teenage sons.